Chatbot for financial services – how to automate back office processes?

The significant increase in using chatbot technology for financial services reflects the immediate need for AI tools that help increase customer engagement. Many companies are already moving towards responding to most customer queries through online chat platforms and chatbots. This will significantly reduce the cost and time spent dealing with customer calls. But can chatbots for financial services automate back office processes?

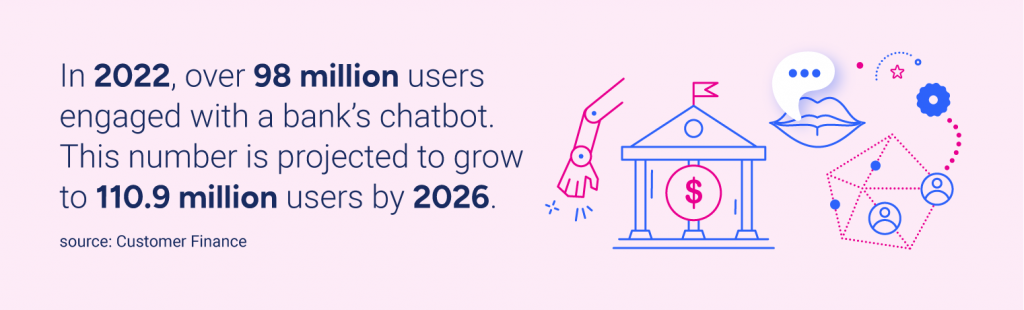

The increased popularity of chatbots for financial services

Financial institutions have been using various channels to interact with customers, such as bank branches for face-to-face interactions, call centers for instant help, or voice response technology to reduce the time and costs of customer service. Then, as the technology grew, banks became more and more online, with mobile apps or live chats.

The introduction of chatbots made all customer support easier. As chatbot technology has evolved, so has banks’ use of the technology. Banks are moving from simple, rule-based chatbots towards more sophisticated technologies such as conversational AI assistants.

Chatbots for financial services are a cost-effective alternative to human customer service. They also assist in dealing with customer queries and complaints. Using chatbots, companies can learn from customers’ past choices and customize their experience by structuring a profile based on their interactions.

Using chatbots to automate back office processes

Although back office processes are not directly related to customer service, 60% of their dissatisfaction can start there. Many IT, HR, and finance tasks are repetitive, data-based, and labor-intensive, making the back office a great candidate for automation using AI, RPA, and workload automation. According to research, RPA in the back office can reduce 70% of the cost of a full-time employee, providing a quick and tangible ROI to organizations. AI, RPA, WLA, and analytics contribute to optimizing task automation in the back office by handling repetitive tasks while leveraging cognitive abilities.

Chatbots can automate around 42% of finance operations, such as accounting, controlling, financial reporting, keeping records, or automating payroll. They are also used for applying analytics in internal and external audits, identifying misstatements in ledgers, understanding algorithms for contract reviews, and recognizing images for checking invoices and financial statements to eliminate duplicates.

Legal issues and privacy-compliance

Using online chat platforms helps companies learn customers’ past choices and customize their experience by building unique profiles. However, under most current regulatory frameworks, financial services providers must disclose whether a person is engaging with a chatbot or human advisor. Especially if the chatbot makes decisions that could impact the customer’s financial interests.

Also, chatbots for financial services are processing lots of personal data. Therefore, companies must consider GDPR compliance issues and the lawful grounds for processing. They also need to acquire customers’ consent. Under the GDPR, consent is not obtained unless it is “freely given, specific, informed, and unambiguous.” One way to get customer consent is to include the consent mechanism with a privacy notice.

Companies must take some serious steps to ensure lawful, fair processing and transparency. They need to inform the customer about the relevant data processing, the type of data collected, and how it will be used. They can achieve it by including the information in the privacy notice and implementing measures to bring this to the customers’ attention before they engage with the chatbot.

Benefits of automation in finances

Financial services can use chatbots to automate business processes and back office tasks with minimal human intervention. As a result, they are the most valuable tools for companies where time and accuracy are critical. But the benefits of chatbots for financial services are endless – and here are a few of them.

Learn how Actionbot uses its Magic in automation. Check out this demo.

Enhanced customer experience

Chatbots can effectively handle financial services and efficiently perform operations that agents once handled, therefore can deliver faster responses and personalized service to customers.

Automated back office tasks

Financial companies are deploying chatbots to automate most tasks, such as handling customer complaints, answering queries, or offering investment advice to enhance customer experience.

Streamlined onboarding processes

Bots are frequently used in the financial industry for onboarding purposes by letting customers set up a new account smoothly without going through the typical steps at the branch.

Reduced costs of customer support

Financial chatbots can help businesses reduce customer service costs, and that’s why the finance industry can use them for quick issue resolution without staff support.

Increased revenue

Companies that have implemented financial services chatbots in their processes can gain new customers on the back of quick support and awesome services, helping them boost their revenue.

How to implement a chatbot for financial services in your company?

Financial companies face many challenges related to their back office processes, such as completing applications and forms. It often requires customers to know a particular product’s details, terminology, or legal requirements. There are also document errors that can lead to delays and even rejections of applications. Also, the workload of financial sector employees due to the need to handle many requests, often repetitive, affects the overall efficiency of the business.

Actionbot, our AI chatbot, using a Natural Language Processing (NLP) mechanism, helps handle such processes, especially while integrated with Fintin, an innovative financial platform. It’s one of the easiest ways to implement a chatbot for financial services, and we have an example to prove it.

The Digital Assistant is a module implemented alone or together with other innovative Fintin modules, such as the Task Manager or the Virtual Dealer, which revolutionize the communication between customers and financial companies and streamline the entire financing process.

The module, combining functionalities of Actionbot and Fintin, includes:

- The possibility of building processes on the conversational implementation of request forms or a classic approach – depending on needs,

- Implementation of processes related to data requirements,

- Completion of necessary information based on user-friendly conversational mechanisms,

- Completion of information by simple mechanisms, indicating improvements to the message in question,

- Use of voice transcription for data recording.

Using chatbots for financial services can minimize problems related to the manual handling of documents. The Digital Assistant, a perfect example of such a solution, will guide the conversation with the customer so that the form is completed with all the necessary information already at the stage of the first contact or data input. In this way, the time required to handle the entire process is reduced to identifying the customer’s need and declaring the case – regardless of whether the final decision to proceed to the next stage is made by a company employee or is recognized automatically.

Meet your future Digital Assistant.Read more about this Module on Fintin’s blog

Thanks to the Digital Assistant module in the Fintin platform, we gain an intuitive, user-friendly interface in the form of an online chat. Importantly, the Actionbot-based Assistant will not only answer the most frequently asked questions, but it will also guide the customer step-by-step through the process of filling in forms and applications, as well as provide them with the necessary information, for instance, on the terms and conditions of the contract or legal requirements.

Actionbot – a great chatbot for financial services

Integrating Actionbot with Fintin proves that our AI chatbot perfectly fits financial services. It easily automates back office processes and uses AI with conversational mechanisms to understand customer needs. If you want to learn more about our chatbot for financial services, read our case study of implementation for Generali Poland or details about the integration of Actionbot and Fintin.