A few chatbots use cases in banking industry to prove the importance of automation

Automation is already reshaping the future of financial institutions. Adapting to disruption is challenging, but companies who manage automation and technological innovations are destined to thrive. Chatbot assistants are the future, that if used right, can help accelerate automation in banking. In this article, you can read about a few chatbots use cases in banking that prove the importance of automation.

Financial institutions – their main goals and challenges

Financial institutions are confronted with innovation in technology, services, and organisational structure. Such changes are often correlated with disruption, so understanding this broad-based disruptive context is essential to see whether the financial sector is reacting adequately. Without such an understanding, many companies will continue to act tactically on innovation, not facing a structural problem that can be dealt with innovation.

Financial institutions perform a wide range of operations – collecting necessary data, making complex decisions, or counselling business leaders. With such diversity of services, the potential for improving performance through automation varies, but we can say that it is essential to unlocking the full opportunity of innovations. Automation, especially robotic process automation (RPA), can become a catalyst for financial institutions to thrive.

Automation in banking can be implemented as proactive support, automation of operations, lead generation, or product advice, but also as a support for the backoffice.

Supporting backoffice

- Accounting – complex journal entries, reconciliations of accounts, maintaining finances

- Invoicing – generating and validating invoices, cash applications, completing reports and audits

- Financial planning – building reports, validating budgets, planning financial forecast, gathering and analysing data

- Payroll – finding errors, calculating reports

Supporting the customer

- Proactive customer support – navigation within bank’s website or mobile application, resolving simple claims, directing queries to live agent

- Automatic claim processing – money transfers, paying bills, recommendation of processes based on the account history, filling up forms, prefilling of applications

- Lead Generation Sales & Acquisition – product recommendations based on customer’s history and actions, next best offer and next best action mechanisms

- Product and Service Advice – proactive product advisory, cross sell, and up sell with hyper personalized approach

Chatbots use cases in banking to prove the importance of automation

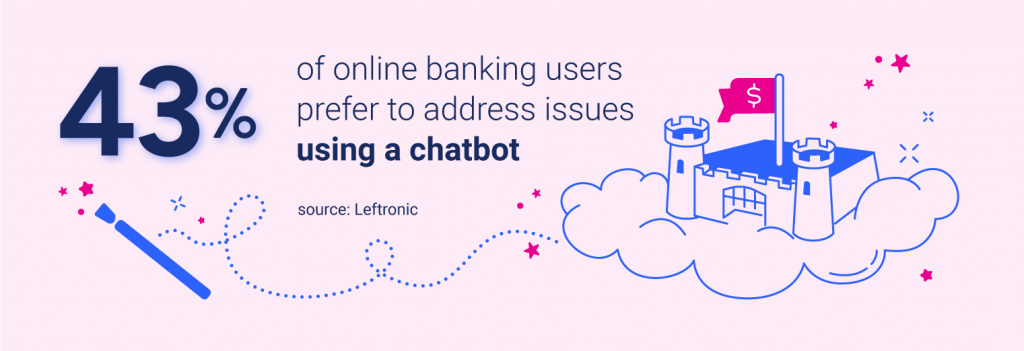

Chatbots are a flagship example of implementing automation in banking sector. Digital assistants help banks, insurance companies, and other financial institutions with simplifying their processes, enhancing communication between companies and customers, and providing proactive assistance and recommendations. Here are a few chatbots use cases in banking that prove how important automation is.

Financial assistant

Customers demand personal assistance at the highest level, especially when it comes to managing their money. And chatbot assistants, as interactive digital agents, are perfect for that. From checking bank accounts, tracking daily expenses, to giving investment advice, chatbots really can become your personal financial assistant and be at your disposal anytime and anywhere.

Automation in banking of the below processes with the help of personal finance chatbot ensure an excellent proactive, and personalised customer experience:

- Checking account balance,

- Filling up forms,

- Making money transactions,

- Analysis of your spending,

- Providing ATM locations,

- Clarifications and explaining financial products.

Cross-selling advisor

Financial institutions offer various products and services, but some of them may be too hard to understand for a typical customer. With all the data collected from previous conversations, chatbot assistants can proactively suggest offers and services tailored to each user and convincingly explain their benefits. You can read more about improving personalization of our chatbot here.

One of the chatbots use cases in banking can look like this – if a customer regularly moves money from one account to another, the bank doesn’t understand the customer’s requirements. However, by having a conversation and asking a few simple questions, chatbots can turn that transaction into a specific financial opportunity, like a mortgage or a car loan.

A chatbot can ask specific questions to make relevant product offers and other chatbot selling tactics. That’s why chatbots collect leads, unlock new upselling and cross-selling opportunities and help financial institutions sell their products, from credit cards to life insurance services.

Actionbot is a perfect up- and cross-selling assistant. It can offer customers more personalised products adjusted to their specific needs.

Check our example on how Actionbot gives recommendations to the customers Try out our lead generation demo

Automatic forms completion

Chatbots collect and store customer data automatically. The gathered data helps financial institutions to understand the areas of customers’ dissatisfaction and adjust the chatbot database accordingly. Also, chatbots can self-improve their algorithm based on customers’ feedback, to provide precise answers in the future.

With such an understanding of customers, it is easier for chatbots to assist in completing more complicated tasks. For example, chatbots can fill up forms for customers, based on the information gathered from the conversation. But it’s not only completing the form that is possible but also performing a few financial operations, such as making a money transfer or processing a claim. Automation in banking is all about being user-friendly!

Actionbot can be integrated with any data source, that ensures its ability to assist customers in such operations.

See how Actionbot can help fill-up the form for customers. Check out this operations automation example

Customer care

One of the biggest challenges for financial institutions is limited support services after office hours. Implementing a chatbot helps overcome these limitations. Chatbots replicate human interaction and can respond to more service requests and frequently asked questions. The NLP engines of chatbots let them interpret the specific customer types based on the conversation and respond accordingly.

Financial services chatbots assist clients in conducting a variety of financial transactions conversationally and securely, from reporting lost cards or making payments, to renewing a policy or handling a refund.

A successful chatbot assistant should offer various functionalities, such as:

- Managing questions and complaints from customers,

- Directing more complicated queries to human agents,

- Measuring customer satisfaction to achieve further improvements.

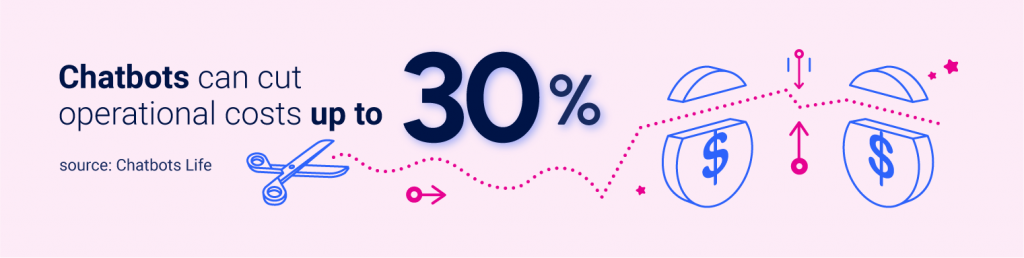

Operational efficiency

Chatbots can also concentrate on operations’ efficiency. They can be the first point of contact for all requests so that agents have more time to focus on more complicated issues or offer more products to customers. By using NLP algorithms, it understands requests in any financial sector. It can respond to more repetitive queries, and with any interaction, it gathers more knowledge that expands its assistance possibilities. Only if the chatbot cannot answer a question, it directs customers to a service desk agent.

Another aspect that increases operational efficiency is the chatbot’s ability to schedule meetings. Not only it can react to customer’s actions and offer personalised product recommendations, but also it can propose a meeting in the nearest bank agency in the most suitable date. After providing such high-level support, customers are more eager to visit an agency and finalised the proposed offer, instead of filling up another form online.

Preventing fraud & ensuring the security

Data privacy and its security is a significant concern in many sectors, but mainly for banks and financial institutions. Also, their technology must comply with different regulations, such as GDPR (General Data Protection Regulation). Financial institutions need to allow consulting, extracting, anonymising, encrypting or deleting data when necessary.

Chatbots can effectively monitor and recognise most warning signs or fraud activities. They can capture transaction data and fetch complex analytics. Moreover, chatbot assistants send automatic notifications in real-time to keep users updated with their account activities. If any unusual notification appears, the customer is going to notify the bank about the possibility of the fraud.

How to make sure your chatbot assistant will be helpful?

Making successful chatbot assistants may not be an easy job, but – as you may already notice with our chatbots use cases in banking – if you follow below rules, it should become easier, and what’s more, beneficial. And it would help with implementing automation in banking.

First, it’s important to remember that when creating a chatbot, you need to start with a limited feature’s implementation. Answering on repetitive requests and having a normal conversation is a good thing at the beginning. After that, you can increase it to other areas, such as card activation, money transfers, or product purchase. It’s the best way to check your chatbot’s value. Actionbot’s implementation takes up to 4-8 weeks. We’re starting it with the most important challenge, but only in the limited scope to speed up the whole process.

Second, you need to make sure to improve your chatbot continuously. One of the main issues customers have with chatbots are drop-offs from conversations. That’s why it’s important to make sure why they do that and how it can be avoided. For Actionbot analysis, we have a tool that helps you understand user journeys, visits, and abandonments within the steps of the dialogue logic. It enables you to investigate each customer conversation by analysing the chatbot assistant’s response and dialogues nodes, or keywords and phrases used. Thanks to this tool, you can quickly pinpoint potential issues related to the dialogue progression and know if you need to train new intents or update existing ones. You may also revise the whole implementation of a dialogue node.

Finally, you need to be present at every stage of implementation. When you decide on Actionbot, you can be sure that we’re taking care of you and the whole process. Our understanding of financial operations and services is crucial in implementing the tool.